.png?width=1200&name=H%26D%20_%20Blog%20Hero%20Image%20Template%20(14).png)

The Government has finally unveiled its highly anticipated plan to address housing issues in New Zealand, after promising a specific focus on affordability and entry into the market for first home buyers. Prime Minister Jacinda Ardern announced a 3.8 billion dollar boost in new builds, a lift in caps for the First Home Grant and the required cost of eligible new and existing homes, as well as a significant extension to the bright-line test up to 10 years, and removal of the current rules around interest deductibility.

These changes shortly after the announcement of recent landlord and residential tenancy law changes and as New Zealand hit record highs, surpassing pre-COVID levels by $130,000, as OneRoof figures show. Inevitably, both property investors and first home buyers are directly impacted by the changes, which come into effect this Saturday, March 27 2021.

If you're unsure on the specifics of the changes and how they will impact you and your family, we've included an outline of the highlights, who they are likely to impact and where you can seek advice on around the changes and your personal situation. Any questions, as always, please do get in touch.

- Bright-line test extension

- $3.8b for accelerating housing supply

- First Home Grant caps lifted, as well as higher house price caps

- Interest deductibility loopholes scrapped

Bright-Line Test Extension

The first of the announcements is the increase of the bright-line test from the current 5-year mark, to 10-years as of Tuesday 23rd March as an "act of urgency" - meaning any gains on a residential property that is not a family home will be taxed if the property is sold within 10 years of purchase.

What is the bright-line property rule?

"The bright-line property rules means that if you sell a residential property you have owned for less than 5 years you may have to pay income tax. This rule also applies to New Zealand tax residents who buy overseas residential properties."

The rule was brought into place back in 2015 and only applies to investment properties, for example, When you sell property the bright-line rule does not apply to your main home, inherited property, or if you're the executor or administrator of a deceased estate.

Who does the bright-line change affect?

This change directly affects property investors, who own two or more residential homes, by reducing the potential margins to be made on residential property through what is effectively a capital gains tax. The tax is paid at people's income tax rate – which means depending on the investors income could be potentially up to 39 per cent on some or all of the profit.

It's important to know that the change to 10-years is only in place for existing residential properties. If you're investing in a new build. the bright-line test will apply for the original five-year duration.

“Investing in property is a long term proposition. For many of our clients they will ride through different market cycles without worrying about this extension, knowing cashflow is king and that they hope to keep the property for beyond the 10 years now in place.” - David Windler, Director of Mortgage Supply Co

The intention of the extension is to create leeway for first home buyers to enter the market and "dampen speculative demand and tilt the balance towards first home buyers", says Finance Minister Grant Robertson.

You can find out more details about the bright-line test and exemptions, here.

Interest Deductibility Changes

The Government also announced that it will remove the interest deductibility rule – which allows property owners to claim interest on loans used for residential properties as an expense against their income from those properties.

According to Revenue Minister David Parker, this rule "favours debt-driven residential property investment over more fully taxed and more productive investments."

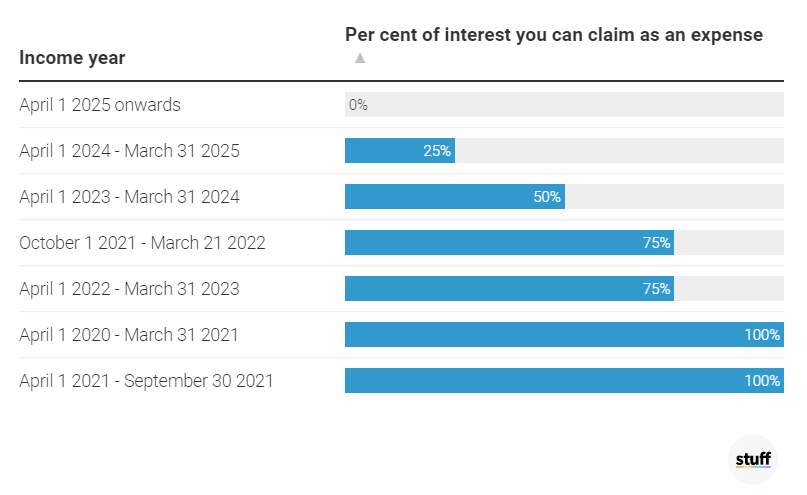

The change will come into play incrementally over the next five years. If you acquired a property before March 27 2021, you can still claim interest on pre-existing loans as an expense against your residential property income, but this will change over time as represented below.

$3.8 Billion Housing Acceleration Fund

A new scheme investing 3.8 billion dollars into the acceleration of the pace of new house builds, which is expected to help see "tens of thousands" of new properties built. Housing Minister Megan Woods suggested that the fund would be targeting builds in the short to medium term, and will "jump-start housing developments by funding the necessary services, like roads and pipes to homes, which are currently holding up development."

For context, this is almost two times what was set aside for the failed KiwiBuild scheme.

As well as this, the Government will allow Kāinga Ora, the Crown housing agency, to borrow a further $2b for it to buy land for housing with the intention of increasing the supply of properties available to rent.

Who does the housing fund affect?

For developers, this could signal the ability to build more developments with consent, thanks to a growing infrastructure system. This will also likely increase the supply of housing, which impacts any home buyer, first home or investor.

First Home Caps Lifted

As we've mentioned in our previous first-home loopholes blog, Kāinga Ora has offered first home buyers (or a previous home owner who has been making regular KiwiSaver contributions for 3 - 5 years) a grant to assist in entering the housing market.

If you tick all of the boxes and your application for a grant is approved, you'll receive between $3000 to $5000 if you're purchasing an existing home, and up to $10,000 for each member in the KiwiSaver scheme purchasing a brand new property or land to build a new property on.

In addition, First Home Loans have also been available for first home buyers, meaning they only need to come up with a 5% deposit, as opposed to the typical 20% deposit required.

The main requirement to access these schemes, is that you must meet the incoming test requirements and come in under the specified threshold. Up until April 1st 2021, this has been $85,000 per year for single buyers and $130,000 for a couple. The house you're buying must also reach a certain threshold, depending on where in the country you're located and if you're buying a new build or existing property.

What are the specific changes?

Effective from April 1st, the income caps for the Government’s First Home Buyer Grant and First Home Loan will move from $85,000 to $95,000 for single buyers and from $130,000 to $150,000 for two or more buyers.

| Income Caps | Previous Cap | New Cap |

| Individual Buyer | 85,000 | 95,000 |

| Multiple Buyer | 130,000 | 150,000 |

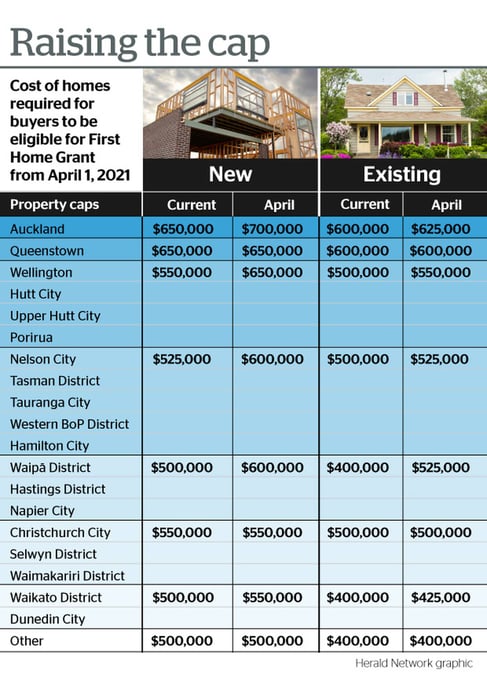

The property price caps would also raise to $700,000 in Auckland, $650,000 in Wellington and Queenstown, $600,000 in Nelson, Tauranga, Hamilton, and Napier, $550,000 in Christchurch and Dunedin, and $500,000 in the rest of New Zealand.

Below is a helpful chart provided by The New Zealand Herald, which outlines the regional cap changes.

Who does this affect?

Primarily first home buyers who meet the income and regional requirements as set out by Kāinga Ora. Minister Megan Woods noted that "This package of measures will help first home buyers into the market and boost activity and create jobs in the construction sector, as we recover from the impacts of COVID-19,”.

You can find out more details about the changes or eligibility, here.

Not sure how these changes impact you?

Don't worry, we're here to do the legwork and help you to figure out if you'll need to make any changes, or be able to take advantage of the new schemes. If you'd like to find our more or some peace of mind, please get in touch with our team below - we're happy to help!