In reaction to the speculation that the official cash rate and OCR may drop below zero in the months to come and the bid to win the business of Kiwi home buyers as the country recovers from COVID-19, we've seen the banks enter what looks like an interest rate war.

In fact, just last week ASB made the move to offer a record-breaking low two-year fixed rate of 2.69%, and Kiwi Bank responded to the forecast change by offering a one-year rate of 2.65%. These rates have literally never been seen before, even considering back in '08 after the GFC when interest rates plummeted by around 3% (from 8.6% to 5.9% fixed) the competitive and reactive environment we're witnessing now is utterly unprecedented.

So what's the reasoning behind the extremely low interest rates and New Zealand Bank wars? Well, ASB executive manager of retail banking, Craig Sims, stated;

"This has been a difficult time for a lot of our customers. While we have put in place a number of support options, including mortgage repayment deferrals and interest-only payments, we're continually evolving what we are doing to help Kiwis get through the impact of Covid-19. Offering this two-year special rate is part of that."

With all this said, how do the current rates really compare to the drops in interest rates we saw two years ago, is it genuinely helpful for Kiwis, and what might be the long term impacts for those that take advantage of these possibly never to be replicated offers?

We aim to answer these questions in this blog. As always, feel free to get in touch if you want further clarification or to take advantage of the current situation!

How do today's interest rates compare to two years ago?

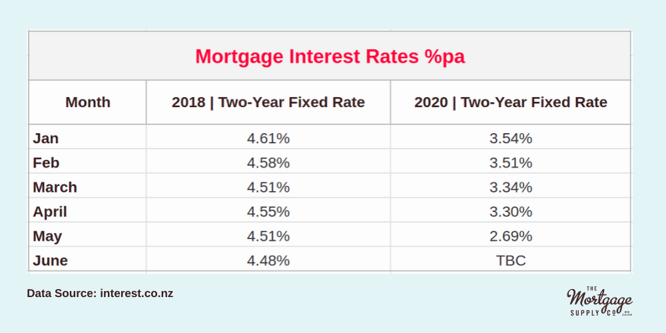

When looking at the same months side by side in 2018 compared to 2020 so far, you can clearly the see the significant drop in interest rates for the two-year fixed rate home loan options available.

There's a 1.82% difference between May in 2018 and May 2020, which communicates the impact that COVID-19 has had one the banks, applying pressure to ease the financial burden on customers struggling through the pandemic financially.

Between January and May in 2018, there was a total drop of 0.1% pa in two-year fixed interest rates, where as comparatively, we've seen an what can only be described as a plummet of 0.85% from the top of the year.

These figures show very evidently that the banks mean business when it comes to interest rate options in response to COVID-19 and reserve bank changes and are more than willing to make moves.

So what does that look like in terms of dollars in your pocket?

If these figures sound like jargon, or perhaps you're thinking "but 0.85% isn't really that much of a drop", when contextualised into actual dollars saved over time, the amount you'll pocket as a result of the drop is significant.

Here's what we mean:

For a $400,000 mortgage taken out against a home with the value of $500,000 (that's a high 80% LVR) at a 2018 interest rate of 4.61% your repayments would be approximately $2053 per month.

- Mortgage: $400,000

- Loan term: 30 years

- Interest rate: 4.61%

- Monthly Repayments: $2053

In comparison, with today's new 2.69% interest rate, on the exact same mortgage your repayments would drop to $1620 per month.

- Mortgage: $400,000

- Loan term: 30 years

- Interest rate: 2.69%

- Monthly Repayments: $1620

That's a difference of about $108.20 per week, freeing up a significant amount of cash-flow for Kiwis who need assistance during the COVID-19 pandemic. Plus, if you're fortunate enough to be making the same income over this period, with a lower interest rate you may be able to afford to pay more than the monthly minimum, effectively shortening your loan term over all.

When you translate the figures into money in your pocket each month - that's pretty amazing. Credit has never been this cheap.

At the end of the day, it's all about the structure of your loan

With that being said, it's important to be aware that the interest rate is only fixed for a two-year period, and it's impossible (especially given the current circumstances) to predict what interest rates might jump to once you exit your interest rate fixed-term. That's why, now more than ever, it's key to look closely at your loan structure.

A lot of people tend to focus on what's under their nose, especially when it comes to buzzword articles in the media surrounding dropping interest rates. This can be problematic if you're taking out a new home loan, as while you may be able to service a loan at 2.69%, it may become more difficult if the interest rate increases, and if you can only afford 2.69% you'll be heavily dictated by changes in the market.

Mitigating that risk is our job here at The Mortgage Supply co. We endeavour to make sure our clients have thoroughly assessed their means, and mitigate the risk of interest rate changes through strategies like diversifying your loan structure (for example, a portion of your loan in a fixed term and a portion floating). Plus, a good rate only matters if you're able to get your approval first, and as we outlined in our recent blog on the removal of LVR restrictions, the banks are getting tougher and tougher on their credit lending terms.

The good news is, we're here to help. If you'd like to:

- take advantage of these record breaking low interest rates

- mitigate the risk of interest rate increases in the future

- leverage the connections and trust in mortgage advisers from the banks to gain approval

- structure your loan to save you money in the long-term

Get in touch with one of our advisers, below.