Property investment in New Zealand has proven over time to be an incredibly lucrative strategy for investors, with the growth of the housing market and the increase in demand for residential property. In fact, last year the nationwide median house price soared by 12.3% to NZ$629,000, according to the Real Estate Institute of New Zealand (REINZ). That's a tidy increase in value from the previous year’s rise of 1.8%.

However, since COVID-19 hit New Zealand in March this year, the property market has been an ever-evolving and changing industry, raising the question with investors: Is property investment in New Zealand During COVID-19 a good idea?

We've taken a look at the statistics and reached out to some of the country's property investment industry leaders; Phil Thompson, Co-Founder of Property Education Company Asset Lab and Nick Gentle, Operations and Co-Owner of iFindProperty, to get an insight into where the property investment market sits as we recover from the turbulence of COVID-19.

As always, if you have any further questions around property investment and changes within the industry throughout COVID-19, feel free to get in touch with our team - we're happy to help!

What does the data tell us?

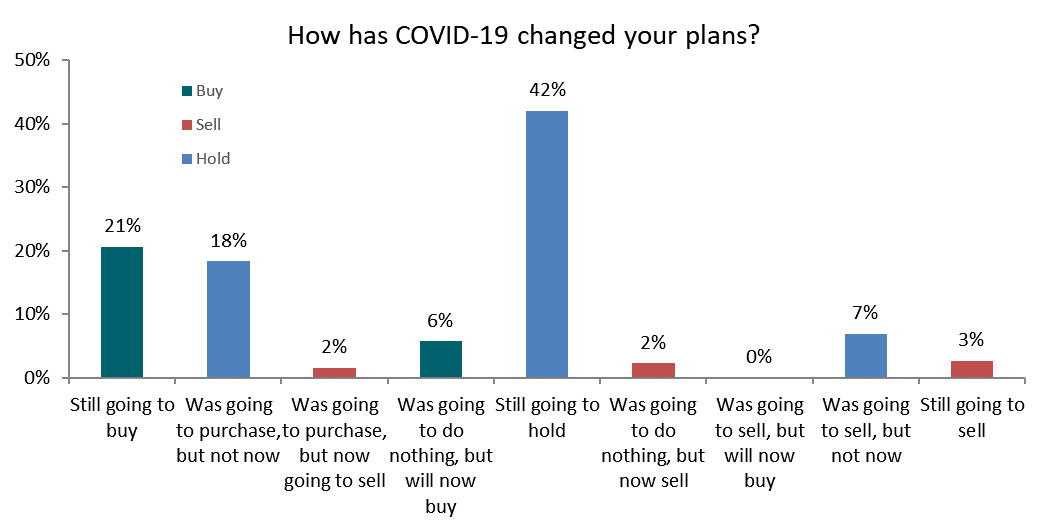

Last month, the team at Core Logic undertook a real-time data analysis of the residential housing market in New Zealand, to find out whether investors would continue to invest in NZ's largest asset class. The results truly speak for themselves.

For the most part, the majority of the property investment market (65%) was unphased by COVID-19 in terms of their sentiment towards continuing to invest, with a further 21% of investors choosing to proceed with their initial plans to buy that they had before the nation went into lockdown.

(Source: Core Logic Study)

If we combine these insights with our own experience here at Mortgage Supply Co. over the various COVID-19 alert levels, it's quite clear to see that property investment is still validated by the sheer volume of activity in the market. Kiwis are willing to take advantage of the opportunities presenting themselves, despite the general uncertainty that COVID-19 has brought with it.

What are the property investment opportunities post-Coronavirus?

If the statistics are showing that Kiwis are willing to invest in property and take risks within the property market, then what specifically are the opportunities that people are seeing in the market, and what factors are quelling any sense of nervousness?

We spoke to Phil Thompson from Asset Lab and found that rather than an expected hesitance towards investing after COVID-19, in actuality, Kiwis have come to realise how important a diverse portfolio and alternative income streams are;

"COVID hasn't changed any of the fundamentals of property investment, if anything it has possibly just made people more aware of the need to invest and to not be reliant on a job as their sole income source"

In fact, there's actually a tonne of opportunity that has come off the back of COVID-19, which Thompson predicts "will be one of those periods that we look back on and wish we had done more while the opportunity was there."

Some of those opportunities include flat prices, increasing uncertainty leaving space for buyers to move, election-year impact, record breaking low interest rates, loan to value restrictions being lifted and a global shift in the economy. As Thompson astutely puts it;

"There are plenty of reasons to be encouraged about property investment right now... Most of the perceived 'negative' factors look temporary, so this is a time to seriously look at taking action if it fits your plan"

... and we'd agree!

The Three Types of Investors Post COVID-19

We spoke to property investment industry leader Nick Gentle of iFindProperty, to uncover some of the different types of investors that are emerging in the New Zealand market and making moves (or waiting to) in the COVID-19 environment.

The 'Wait and See' Investor

The first is market-cycle driven and wants to "wait and see". These are buyers who want to invest but don't quite have confidence in their own situation or confidence in the market to make a move.

Everybody moves at a different pace and we (iFindProperty) make a point of not pushing clients into deals they might not be ready for. We suspect this year with COVID and then the election many of these individuals might sit the year out, the news papers are chock full of bad news right now.

The risk of being in this group is that if you are trying to pick a top or bottom it is very hard to do. Famously some economists called Auckland "done" in 2013, sold up and moved out of town!

The Opportunist

The second group sees that the opportunity is right now. Interest rates have crashed further so deals that were slightly cashflow positive are now very much so. These buyers want to move while others are apprehensive and our role is help them take those opportunities but stick to the fundamentals; i.e. make sure they buy properties at a good price, good area, opportunity to add value, increase cashflow, increase equity and meet their buying rules and long term plan. So the same as always.

The 'Long Term' Strategist

The third group is a constant with us in any market: buyers who on their own timeline have decided to invest in property, understand that it is a long term game and are ignoring what is happening around them. Usually these buyers have good deposits and focus on good areas. They are careful and methodical, happy to grow relatively slowly and use us to help them find a deal but also to avoid a mistake.

So, is it a good time to invest?

The short answer is yes. It's a good time to invest.

The industry leaders around us are resoundingly saying that the market is rife with opportunity, deals are turning cashflow positive thanks to the loosening of LVR rates and the lowering of interest rates. Plus, the flurry of movement that property businesses are seeing across the board acts as a vote of confidence - people are ready to make moves, and making moves as we speak.

If you'd like to find out what you're options are and make an investment in the property market, we're here to help. At the end of the day, a good investment decision starts with the best possible financing and mortgage structure, and we're here to help. You can get in touch below!